On October 16, 1959, Richard Bevir and Terrence Whitfield left Toronto, Canada, in a light, but rugged Range Rover.

Their mission: drive to South America.

Driving through the U.S. was a breeze. Their progress, however, came to a screeching halt when they reached the Darien Gap, a roadless stretch of jungle, that still exists today.

Little did they know they were in for hell.

The Darien Gap is still one of the last wild places and separates Central America from South America with its roadless expanse—the pinnacle of experiences for the experienced adventurer. In fact, it’s a no-man’s land full of paramilitary, rebels, snakes, wasps, and thorns.

You name it, everything that could kill you is there.

At one point Whitfield drove the Rover across a skeleton bridge made out of palms. It didn’t take him long to realize it wouldn’t hold.

The bridge eventually sagged and spilled the Rover onto its side. Whitfield climbed out unscathed. But it wouldn’t be the last time he flipped the Rover.

Near the Colombian border, while climbing a steep ridge with the winch, a pulley pin snapped. This sent the Rover onto its back. It then rolled side-to-side 70 feet down the hill, coming to a rest at the bottom. It took a few minutes, but Terry eventually climbed out of the Rover.

The expedition finally reached a river where they built a raft out of balsa logs and floated to safety, eventually reaching Bogota, Colombia, their destination.

Crossing the rest of North and Central America was a piece of cake. Panama alone took them 134 days. With a total distance of 310 miles, that’s less than 3 miles per day.

In all, the expedition crossed 180 rivers and creeks, built 125 palm log bridges and 3 rafts and endured 90 tire punctures, malaria, jungle exhaustion, and dysentery.

Their diet during the trip? Rice, banana, monkeys, and lizards. That’s right. Monkeys.

And when their journey was over, Bevir and Whitfield were heroes.

They went down in the history books as being the first to cross the Darien Gap on land. But more importantly, their work helped with the eventual building of the Pan American highway that crosses the Central American isthmus today, connecting almost all portions of the Americas, except for the The Darien Gap.

Now, I’ve never eaten monkey before. But I’ve been in plenty of situations where I’ve encountered the exact same terrain that Bevir and Whitfield encountered. And it usually occurs when we get a tip that the government is about to put in a new road or electricity.

Like Bevir and Whitfield I have covered a lot of ground. The purpose of my travels was to explore and look for good investment locations. As a result I have driven or hiked the entire Pacific Coast from Vancouver Island, Canada all the way to the southern tip of Ecuador. Town to town, place to place, I have been studying what works and what doesn’t when it comes to investment and community prosperity.

And it’s not only about investing for financial success, although that’s important too. We think there’s more to it than that. But I’m getting ahead of myself.

Whether you are looking for the perfect second home or you want to build your own town from nothing, you will find the information in this book valuable.

Stuck. Nowhere near roads, no other cars to help. You won’t believe how we escaped. Click here to see.

The short answer is that we can’t do it alone.

And we’re hoping that as you read through the book you will be inspired to join us in some way.

We’re extremely passionate about the experiences to be gained in the communities that we’re building and we’re willing to give away some profitable strategies in order to bring more people on board.

The other reason is that investing in Latin America can be quite daunting for the foreigner. Frankly it was quite frustrating when we got started because we had to start from scratch. We would have been ecstatic to piggy back off the work that others were doing.

By helping you with our framework, we’re increasing the odds of more communities and investors in the region who are doing something remarkable.

It will be up to you to take action and use it for your own success.

When we consider investing in Central America, we’re talking about more than simply stashing dollars because that doesn’t inspire us. And frankly, that’s pretty boring.

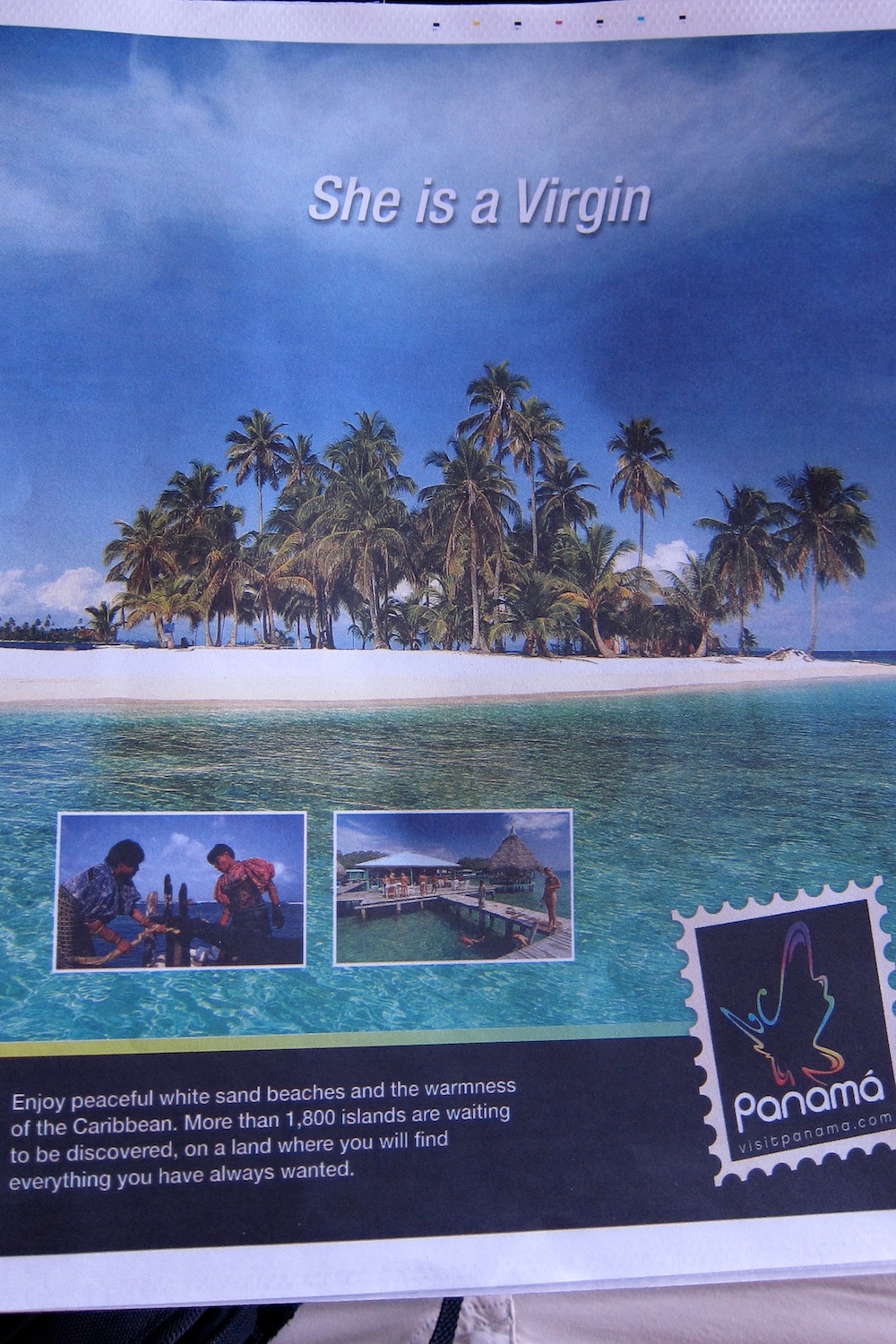

What intrigued us before we moved here from North America (and still does to this day) was a vision of wild and beautiful places where we could escape from the clutter of our lives and experience life in a way that simply isn’t possible back home. What inspires us today is making that vision a reality for our clients by building communities that blend their love of nature with interesting and unconventional ways to live here.

We want to attract dreamers, people who want to think outside the box. However, we understand that not even the dreamers will invest in a vision without a profitable opportunity to drive them. Fortunately for them (and us!),

these ventures happen to be extremely profitable!

So this book is about more than just the numbers and the mechanics, even though you’re going to learn them in the chapters that follow.

More than that, it is our hope that by giving you these methods, you will enrich the region by either creating your own special haven or coming alongside us and building one together.

Playa Burica, Panama an Adventure Colony in striking distance from several amazing outdoor experiences

History has progressed through generations to arrive at this time, which it turns out is a tipping point for the Latin Tropics. The convergence of raw and undeveloped lands with technology is creating the best time ever to invest or live in these emerging countries.

Build a community or just get away from where you live. Create a sanctuary in the rainforest, escape into the jungle wilderness, get a reprieve from our modern hectic lives and recharge.

Now is the time.

The profits that can be created are staggering, going as high as 1000% Return on Investment.

You just have to know how to spot the deals, and you are about to learn how to do exactly that.

For nearly two decades, Emerging Terrains has been buying pristine land in the tropics and transforming it into communities for those who have a deep appreciation for wild and beautiful places. From investors in our projects to folks buying land in our communities. From builders to photographers. From surfers to fishermen. We want you to join us in making money while creating a new way of living in our Viva Communities.

Be sure to touch base with us and learn how you can join us in building communities that are remarkable.

We’ll talk more about that in the last chapter.

In this guide you will learn how to prioritize what is important when it comes to real estate investment abroad, create your own scouting machine, build your own network, and use our experience to do it in an incredibly efficient way.

You can pick and choose the parts you like and adapt our ideas to your own needs. Or feel free to copy us step by step. These

methods are tried and true. They’ve worked for us and for others, and we think they can work for you.

The ideas in this book are meant to shape the way you see land and the way you approach investing in it. The lessons contained here are more about the macro point of view, not about turning you on to a specific area to invest in. We want to teach you about more general and wider trends and ideas that will arm you with the information you need to assess real estate.

Let me ask you a question.

What if you knew beyond a shadow of a doubt that a market existed for a piece of property…

But not only that a market existed, but also that you could invest in that property at such a steep discount that your risk would be almost zero and your returns would exceed 100%…

AND you knew with almost one hundred percent certainty you could sell that property…

Would you invest?

If you said yes, keep reading, because I’m not only going to show you that it’s possible, (because I have a feeling you may doubt me) but also how you can get started.

How Gmail beat entrenched competitors

On April 1, 2004, the search company Google invited a limited number of people to use a new product they were testing.

That product was Gmail, an email service to compete against entrenched giants like Hotmail and Yahoo.

No it wasn’t a joke. They were serious.

Google offered users one gigabyte of space and the ability to receive up to 10 megabytes in a single e-mail—more than the free services of Yahoo! and Microsoft’s Hotmail allow for storage in an entire mailbox.

Customer development in its simplest form.

In addition, users could search emails by sender, topic or other keywords and organize them according to conversational threads.

This was a first. And it would prove to be a winner.

How Google came to this decision is instructive: Google co-founder Larry Page said the idea to launch Gmail had emerged from a complaint lodged by a user of the search engine who was frustrated with her email service.

They were listening to their customers. And building and delivering the products they wanted.

But Google didn’t stop there. Gmail remained in beta testing for the next three years. Why? They were watching to see how people used Gmail and listening to their suggestions. Based on these observations and suggestions, Google tweaked Gmail.

The product only got better. And more appealing to the public.

On July 2009 Google upgraded Gmail from beta. It proved to be the superior product and it was pretty much near perfection because of Google’s use of the beta paradigm.

That paradigm—launching an imperfect product early and tweaking it often based on user behavior and suggestions—gives companies the ability to build a superior product based upon the needs and wants of customers. This is a stark contrast from the old paradigm, developing and building a product based upon assumptions and opinions of what customers want.

And it’s that paradigm, along with another Silicon Valley innovation, that allowed us to succeed in the collapsing global economy when the old paradigms weren’t. Let me explain.

Park and I aren’t shy about it: we are geeks. We are technology geeks. We are marketing geeks. AND we are business geeks. That’s why we like to follow what’s happening in Silicon Valley. It may seem like a stretch to see how this relates to real estate in Central America (especially if you’re more of a free spirit and not a geek like us), but just bear with us. We’ll get there.

As you know, lots of technological innovation comes out of Silicon Valley [Google, for example]. But did you know there’s also a lot of business practice innovation coming out, too?

One particular business practice is in the arena of customer development. It’s called the “product-market fit,” and because of technology like the Internet, the cost of testing the so-called “product-market fit” is approaching zero.

All “product-market fit” entails is creating a product for a segment of customers who want that product badly—and getting it in front of them. Think Gmail. You have product- market fit when you have people giving you money for your product. That’s validation.

The core takeaway is that most businesses fail not because they don’t manage to develop and deliver a product to the market. They fail because they develop and deliver a product that no customers want or need.

Google developed a product customers wanted, and they succeeded with Gmail.

Even though our product is real estate, that’s a misleading description because people don’t buy real estate. They buy an experience. A lifestyle. You don’t want that piece of oceanfront land because you like dirt. You buy it because of the lifestyle you imagine it will entail.

And we’ve learned that the vision that’s cast for a property will shape the experience of its future owners and will actually determine the type of owners who buy, and what they will build.

Like in almost all other areas, we are relentless and meticulous about our research and our data. We measure every significant point of the sales funnel to make it the most efficient and profitable funnel out there.

We test a “Minimum Viable Product” by putting it in the marketplace…having a mechanism in place for getting feedback from real life customers…modifying that product based upon user behavior and suggestions… and repeating the process until we have that product-market fit.

By eliminating, from the beginning, the people who aren’t the right fit for our product, we avoid wasting our time and energy on marketing to the wrong people. Instead our

Once you know what customers are looking for, find out how to get it to them.

sales funnel only attracts the right person for the product.

We’ve learned where to find our customer, what they like, and how they want their products packaged. We know this about our customer because we’ve watched and listened to him. And we are constantly tweaking our customer profile and refining our sales funnel based upon our customers’ feedback.

This constant tweaking has made us agile and allowed us to survive the economic downturn. It’s also what’s helped us build a database that tells us that a market exists for the property we are investing in and selling. And it’s why I can make the strong promise I did in the introduction.

By now you know the first step in any good real estate investment is knowing your buyers. So, the following steps are all thing you will do BEFORE you ever invest in the property.

Later on there will be a process of getting to know them that will allow you continue to zero in on who you will ultimately sell to. But first, you need to make sure there’s a market for your property.

We want to know before we buy a piece of property if it’s something that people will want.

Is there a market for this piece of property? Do they want 1/2 acre lots or 10 acre parcels? What price point causes people to respond? What type of people are interested? What are their preferences? Proximity to an airport? Is it because of a surf break?

Thanks to the internet, you can learn a lot about product-market fit before you risk too much capital. Then over time, you begin to know a customer so well, you’ll know what they want before they do. Then you can go get it and give it to them.

After we follow the steps above and get some feedback to know we are on the right track, we go a little deeper.

For each lot we build a landing page. And then for the mini-website for each lot we add videos, articles, and blog posts, building a virtual wiki-page for that lot. In time it becomes a destination that pulls interested buyers in—and keeps them there.

One of the ways we know this is that we’ve had buyers come out to visit a property after spending time on our website and end up knowing it better than we did. That’s because they’ve watched the videos, read the articles, and followed the blog posts so closely that they’ve become, in a sense, masters of that lot. This is what happens when you nail the 5 steps above.

After going through the process a few times, even on the same piece of property, you can achieve close to 100% closing rates with

property buyers. You can know the buyers better than they know themselves.

The beautiful part? We’ve carved out a competitive edge over our competitors in Central America that will never lead to trouble. Only profit. When things aren’t working, you can always go back to the feedback loop and refine the product (land size, house type, etc) you’re offering and the way you’re describing it.

If you take one thing from this book, understand that real estate investing isn’t about land. It’s about people. Learn as much as you can about the customer who will buy your investment BEFORE you invest.

You’ll be iteratively spending your time getting to know the customer, finding the property that will work for that customer, and getting feedback from them. If you already own a piece of property you can use this system for figuring out pricing, lot sizes, etc.

Let’s start with a story.

Technology—even simple and crude technology—can give someone a substantial advantage over competitors.

Take the horse, for example.

Unlike most other large animals, the horse wasn’t raised for its meat, milk, or hide. Rather, the horse and its incredible power was groomed for plowing, pulling carts, and carrying humans—most notably into war.

Just the sight alone of a mounted soldier on a horse struck fear into opponents.

Hernando de Soto famously rode his horse into the Inca Emperor’s throne room. Legend has it he got so close to the emperor that the horse’s nostrils stirred the fringe on the Inca’s forehead. But it was Hernán Cortés who demonstrated the enormous advantage that the horse could have over an enemy who was not mounted.

In all, Cortes defeated over 5 million Aztecs with a cavalry of just 1,000 horses.

That type of competitive advantage—the horse as an exclusive instrument of war nobody else had except for the Spanish—is a lot like the advantage available to you if you follow this guide.

Boca Chica Island, Panama www.bocachicaisland.com One of our signature communities, where people can enjoy privacy and solitude on an ancient, rainforest-covered island. Owners pass the time by enjoying their surroundings or exploring the palm-lined archipelago in the nearby Gulf of Chiriqui. Whatever your interest, the island will serve as an outpost to adventure for the lucky few who call Boca Chica Island their own.

Speculating on property, building something on it, and then hoping that someone else will pay you for the “value” that you have created…

Is too risky a model.

See, the way we make money as investors is to make sure that we have so much momentum we can hit the ground running and carry on through to the end of the project, while creating a successful community in the process.

How do you do that? Get a good deal, know who you will sell it too, make sure a new road or airport is coming, and then know exactly where to market your project, and that is it. Sounds a little complicated, doesn’t it?

Take our Playa Burica project, for instance. We knew the road was coming to that property. Others didn’t.

Why? Because it was the kind of information you pick up from scouting and being on the ground. We were able to confirm with the local mayor that not only was the road planned, but it was funded. Knowing the money was there was just what we needed to know before making the choice to invest.

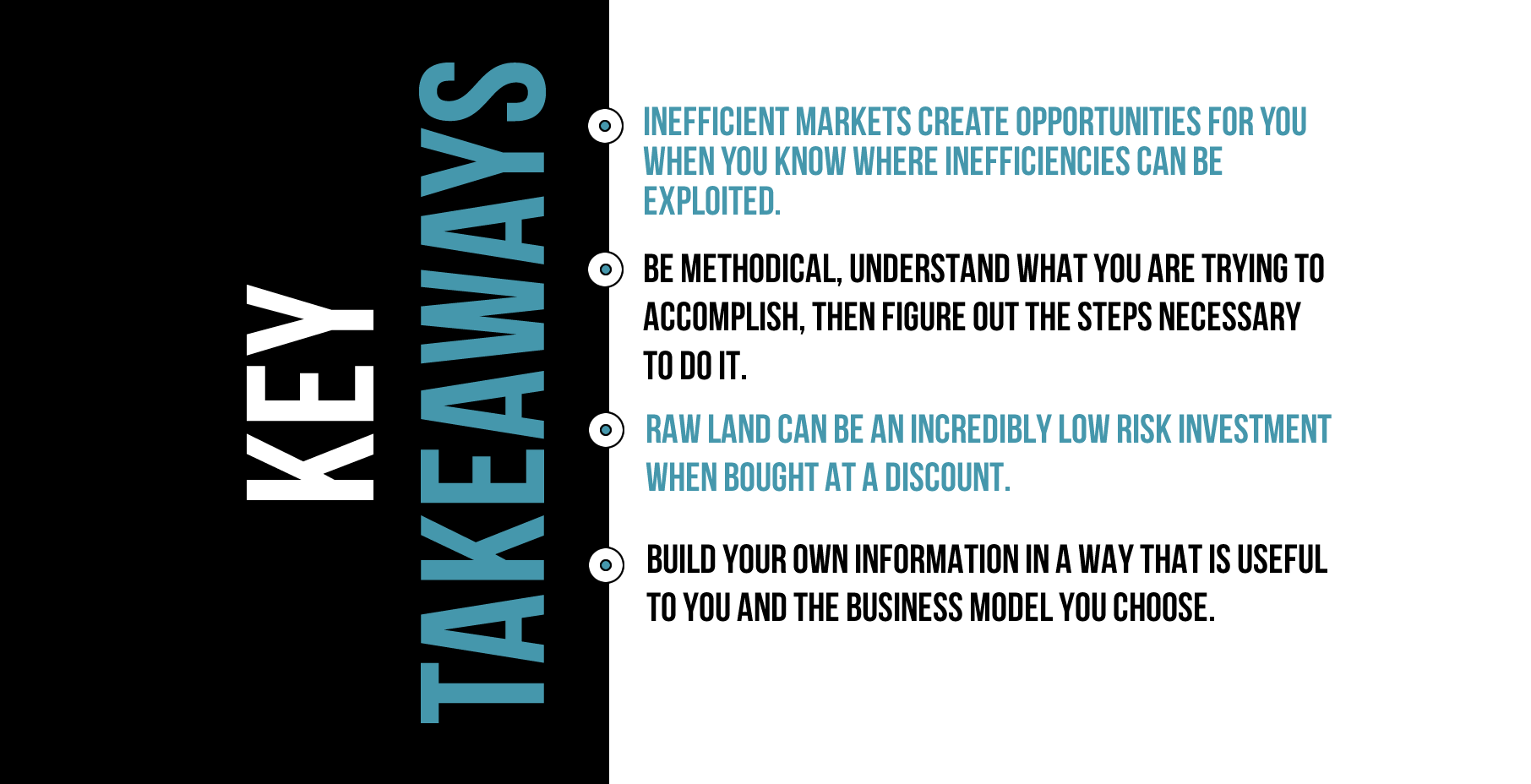

Throughout Central America, there are thousands upon thousands of landowners. But there is no source of information that is reliable for determining the value of properties from market-to-market and from country-to-country.

However, that information is there for the picking. And you can harvest it.

With no MLS or Multiple Listing System down here, the process favors individuals who are willing to put in a little work to find the information. That’s why we’ve hired a nimble force of locals and private investigators, native to their particular country, to approach landowners.

First, we identify a 5 to 20 mile stretch of coast. Then we send the scouts out. The scouts approach the owners, and find out information about what is available and the story behind each farm.

The scouts ask how much the owner would sell his property for. And because he is a local, and this is important, the scout gets the local price—not the “gringo price.”

Note: Gringo Price, means the inflated price that is given if a seller knows they are selling to a foreigner, who might be presumed to be naive and/or loaded with cash.

In Central America we observed that the real money was made on land by itself, with the least possible amount of effort spent on development. The headaches, risk, cost overruns, and problems with regulatory agencies all came from construction. That’s why we built a model that would reduce our risk and our investor’s risk while increasing

profit. You can always build later, but it’s limiting if that is the only exit strategy.

We’ve found that model and we know it works. Our Playa Burica project is proof.

Morning meeting to discuss yesterdays recon work.

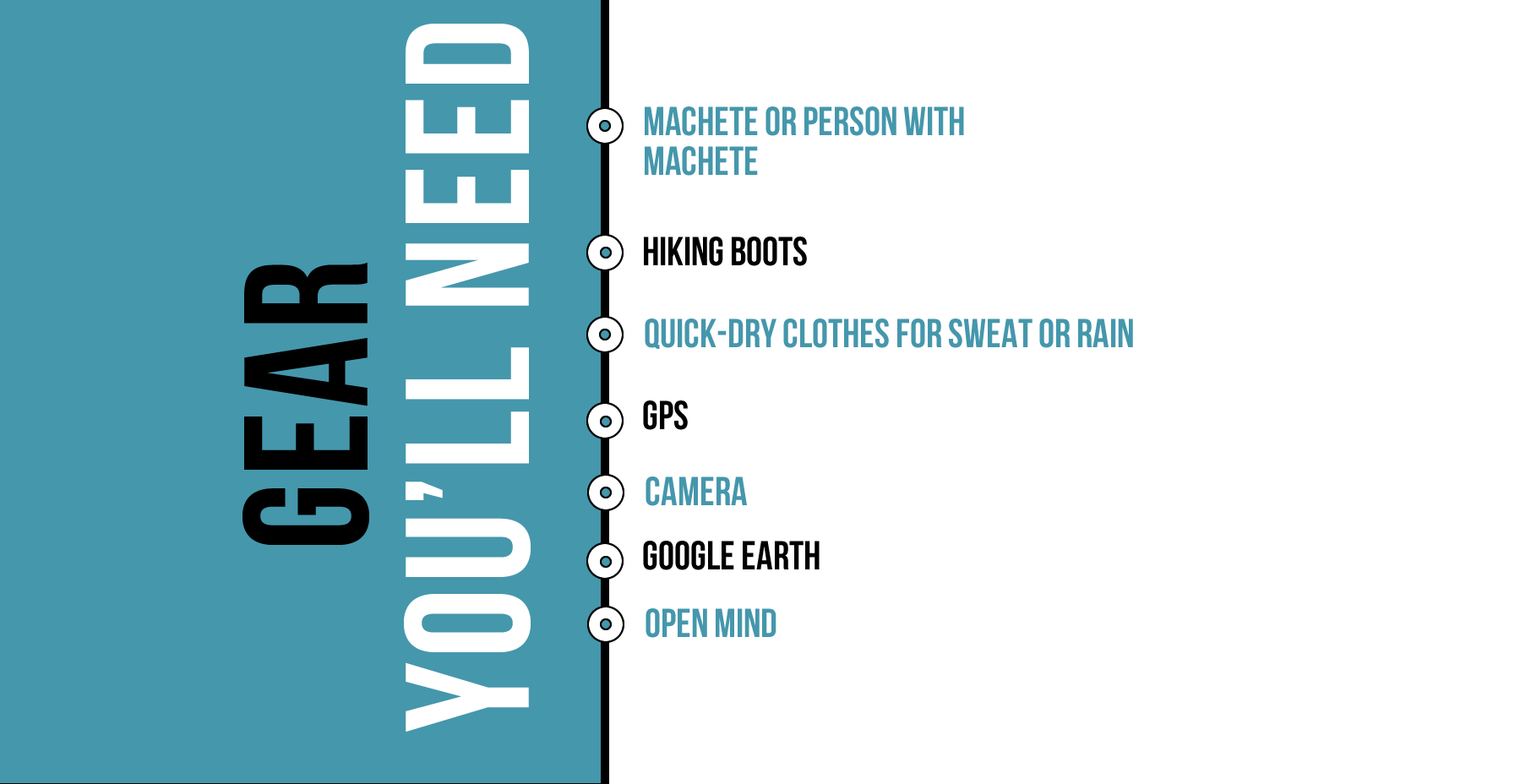

The scout takes down this information. And because we equip each scout with a GPS, they demark the boundaries.

Furthermore, they interview neighbors, take down notes and explore the area.

When the scouts return, they download all this information into a database. This is happening hundreds of times a year. It’s like we have tentacles going deep into places nobody else is going and bringing back information nobody else has. And it’s what separates us from every other competitor.

Why we know our model works

Listen, we’ve put a lot of thought into this model. Furthermore, we have quite a bit of experience in most of the niches in the real estate business…

However after considering all of the potential models and how they could be implemented in Central America, we know we landed upon the right one.

Scheduling a trip to explore real estate in a foreign country can be intimidating. We have developed a system that we use every time we enter a new country to scout. It will also work for you.

The first step to scouting out any new country is to meet with attorneys. Why? Well, not having a reliable attorney in these areas is like refusing to wear sunblock. You will get burned.

Second, we don’t have time to build our own network, so we need to borrow someone else’s.

Why do we do this first? Simple. The laws of a country are the rules of the game; you need to know the rules before you play.

If you are serious about buying property, your attorney should also be part of the scouting process. When you are on the ground looking at properties in your target area, you might have questions on everything from zoning to concessions to easements; you will need answers to these questions to help decide what property is right for you.

Get out in the water after you build your network since it only takes two days.

Generally your initial meeting with an attorney is free, making this the ultimate information hack. If you meet with lots of different attorneys you will get lots of different perspectives. It’s like starting your trip with a seminar on how to buy real estate and what to look out for in your chosen country.

On our last trip to Ecuador we met with 15 attorneys in two days, 10 attorneys in 36 hours on our first trip to Panama, 13 attorneys on the first trip to Costa Rica. Seriously.

The amount we learned was staggering and, not only that, we found a couple of really good candidates to work with on a future deal. After learning the laws we were prepared to evaluate property and determine value and strategies for projects.

Once your attorney search is done, do the same thing with brokers.

The purpose of meeting brokers in the city is that they generally have a big network too. They are used to having people come in and want to buy something in a different area. Often they will have a network of contacts to serve this type of client.

Meeting number 8 in Ecuador

Meet with at least three attorneys in the capital city who have closed real estate deals. You can start your search for attorneys on the Martindale website, and you can ask real estate brokers for recommendations via email before you arrive. More creative options are to use local blogs or expat sites to find recommendations.

Email as many as you can, pick your favorite three, and set up the meetings. Also be sure to ask them if they have any favorite real estate brokers. This may help you move to step two more quickly. If you want a good “time hack”, try to schedule all your meetings at your hotel.

When you’ve just arrived in a country for the first time, it’s safe to say you don’t know anything. Start your interviews with general real estate questions. (See below for sample questions.) The attorney you pick needs to be the person you think can help you most. This depends on your priorities and where you are looking for deals. We usually don’t make this choice until we have a potential deal. That way we can call and discuss options with our favorites while we are looking for properties.

Once you get to the interviews you want to narrow down the people who can help you most. You don’t need to pick anyone before you leave to scout out property. Just get their contact information and tell them you’ll be in touch.

Note: Often the best firms are in the capital city of Central American countries. The level of professionalism is generally higher in the city. You want to meet attorneys in capital cities because their firms have a network and you can use it if you are a client.

We use the same strategy above for brokers. Set up meetings, interview them, and find several to add to your network. Brokers have all sorts of helpful information and they are motivated to help you since they get paid to connect you with a property.

You probably won’t be able to ask all of these in a single, initial interview, but you should at least know the answers to these as a start.

The core of good scouting is gathering information you can rely on.

The methodology we developed for scouting in different places was based on necessity. How can you arrive a new destination and understand a market well enough to make an informed investment decision within 24-48 hours?

From brokers to farm owners, everyone has an agenda and those agendas influence how information is given to you. Because of this fact, it’s important to have your own information gathering system in place.

This is how we do it.

Heading out on our way to see an 800 acre farm on waterfront in Costa Rica

Organization is key. Most likely you won’t have extra time on a trip. As a result, scouting efficiently requires pre-trip planning. Before you even leave home, set up a schedule to see properties when you arrive. Start with emailing brokers, tell them your plans, and meet them bright and early on the first morning of your arrival. Look at as much property as you can see.

You are not only looking for properties you like, but for properties in general to create the context you need to make a good buying choice. A good scout can arrive in a town and within 24 hours understand pricing and where to focus for opportunities.

The way they can do this is by creating context quickly by gathering general information.

If you are really exploring, there won’t be any brokers in the area. So what do you do?

This has been common on our scouting missions. What we do is drive into the area and start talking to people. You would be amazed what you can learn by just talking. Usually someone knows someone who has

or is selling a farm. You may end up having a meal with the people you just met.

The process without brokers is initially slower as you can not get it scheduled before you

If there are no brokers you have to gather your own information.

go, so you’ll need to plan an extra day to get things going. It won’t take long once you begin talking to people, as these places are often small. Everyone knows each other and the history of the area. You’ll also need

to speak Spanish to do this or else bring someone who does.

Scouting in the Andes, sometimes you just have to walk.

Before you even come down you can do lots of research on the internet. Finding places, properties, and brokers are all things that can be done online. You should absolutely begin with looking on the internet and looking for properties you like. This is where you put together your initial list to bring on your trip and it’s a necessary starting point if you want to get started the moment you arrive.

You have arrived at your starting point for scouting. It’s the first town, city, or inaccessible stretch of coast and it’s time to get busy. Hopefully you’ve prepared a list of properties and have scheduled meetings with real estate professionals.

Once you arrive, go to brokers’ offices, meet your scheduled appointments, bu don’t be afraid to ask locals about real estate too.

Often locals know about farms for sale or property that is not on the market. You are looking for someone to be your point man, the person who you will go through to see, find, and map out potential targets. You’ll already have a legal team ready, so you should have confidence in dealing with any real estate legal issues that arise.

This doesn’t mean you should be unsafe, it just means that there is no reason not to see any property you can.

Note: You will need an attorney. They are your backstop for evaluating deals. From legal questions, to zoning, to strategy, attorneys can help with all of it. (See the later section, How to Build Your Network in Two Days)

Keep notes and begin to compile a written log of prices and sizes, and any other notes you want to make like easements or very steep topography. Pay attention to what type of properties are for sale in the area. Are they mostly lots? Are

they condos? Gated communities? You need to acquire property below market value if you want to seal a good return in the future. The way to do this is knowing pricing backwards and forwards.

You are also looking for geographical pricing changes. For example the cost of land is $10sq/ mtr over there, but it’s $1sq/mtr over here. Knowing these variances is very helpful when buying. Figuring out what causes the difference is equally important to know.

At this point you should be seeing property with Brokers and anyone else who has a deal. Grow your knowledge and don’t get attached yet. Keep looking at property until you feel confident of knowing a good deal when you see one.

You can even begin to test the demand and get feedback immediately with a good pay-per- click ad on Google. Use your pictures from the day and start seeing what interest is out there for the area you picked and the pricing you would like to use.

Be patient and go through the process of learning about the area and its subregions.

Pick three properties you like and begin negotiating directly with the owners. Brokers generally get in the way at this stage and slow things down. What we do is have them step out and let us negotiate our own terms.

If you don’t feel comfortable doing it yourself, then ask to be present at the negotiation so you can read body language. It’s virtually impossible to know how low a seller will go without seeing their face. Once you lock in a deal you should feel very confident about knowing you got a good price if you performed the previous steps correctly.

Note: We have had negotiations last 10 hours, and we have had negotiations last one hour. Don’t rush. Build rapport, and have fun.

Draw up a contract. Make sure the agreement includes time to inspect and perform some basic studies before you have to lose any money or buy the property.

Confirm utilities like water and electric service. Make sure there’s access to the property, and schedule a home inspection if needed. Calculate the costs of getting any needed work done during this period, and always get multiple bids.

This is also the point where we like to spend some money testing various descriptions of the land in adwords or craigslist.

Congratulations you just got a smokin’ deal! Take a breather. The real work is about to start.

Planning Monte Vida Park, the world’s first crowd funded park. www.savemontevida.com

Due diligence is the process of testing assumptions. This is your opportunity to find out if you acn put the road where you want, whether the title really is safe, whether or not you can subdivide, or wheather you can build the type of house you are envisioning or any number of other considerations that will impact your investment.

You are responsible. Do not trust anyone else to perform the management of this process. You could have engineers or attorneys, or development partners, but you can’t rely on them to make sure things get done right. These people are only tools for achieving your dream.

They can help you, but they can also screw it up. To avoid this, you should get second opinions on everything that will be critical to your deal working out. If it’s a house you are going to live in, then title and house quality are the main variables. If it’s a project, then there are all sorts of things to confirm.

The best approach for due diligence is a methodical one. Look over your deal, look at anything you can think of that, if it wasn’t true, would cause the deal to be dead. Make a list of these things, and then go through them one by one and make sure that your assumptions are correct.

We usually get a second opinion on everything. That way we can cross-reference the information. You will not be an expert in a new place, so the more information you get from different sources the better.

Give yourself at least 30 days if you are organized. If not 60 is better if you can get it.

Do not get all your information from one source. Make sure you have multiple sources of information.

Due diligence extends to many different pursuits.

How in the world do you make sense of any information in Central America? Pricing is all over the place, highest and best use is questionable, and you essentially have to guess if a place has a future on not.

If you don’t know the answers to these and many other questions, your chances of buying a bad deal go way up.

We ran into the same problem. So we’ve pioneered a data-driven approach for classifying properties based on their market stage. We have observed five distinct stages of land development in emerging markets. Each stage is characterized by different types of land-use and is attractive to buyers for a variety of different reasons.

Every tourist/expat town goes through more or less these same stages of development as it grows. It starts as farmland or forest. Then step by step over time it transforms into a big town or small city. The process is a very predictable and, once understood, it can assist in timing an investment or avoiding a bad one.

Full moon shoot in Panama

We created the tool because we needed a framework to compare towns and areas all over the Latin Tropics. There are lots of details that can vary widely from town to town, but the stages themselves and the customers who buy in each stage are predictable.

Land in stage 1 is priced based on its value to the local community. Economic potential based on international valuation has yet to occur. So a location that has a fantastic view or sits right next to a beach isn’t any more expensive than a nearby plot without those features. Both have similar value to the local economy.

Stage 1 areas can be found all over Central America. Outside buyers interested in these properties tend to be pioneers with an eye for the land’s future potential. They also tend to be people who like adventure, as they may have to find these areas on horseback or by boat.

People interested in buying land at this stage should educate themselves on the difference between an excellent piece of land and a merely adequate property. They may have a long-term goal for financial return, but mostly they just love the areas.

As international buyers start to arrive with a new end-use for the land, that’s a sign that the market is beginning to move to stage 2.

These properties are characterized by early buyers who recognize global commercial potential and speculate on higher future value, even though an international market

Stage 1 land prices are based on agricultural value.

for these properties has yet to develop. Buyers are lured to the area by the opportunity to enjoy their own gorgeous piece of land at a ridiculously low price. Often these properties have no road access or utilities.

However buyers at stage 2 can heavily influence how the area develops by establishing the tenor of development as other investors seek to build complementary businesses. Buyers of stage 2 properties tend to be speculators who enjoy adopting an area, influencing how it grows, and seeing it mature according to their vision.

As word begins to spread locally about speculative buyers paying higher prices, more money is drawn to the area, feeding the cycle and moving the land toward stage 3.

Early buyers who purchased larger parcels at bargain prices begin to sell off small parcels at a much higher price. Stage 3 buyers who expect infrastructure, services, and community to be in place or arriving soon, start purchasing land.

Stage 3 markets are characterized by smaller lots starting to sell with a few houses popping up. These areas don’t look much different from a stage 2 market as very little building is happening.

Most transactions are still speculative, and the construction of basic amenities is in the early stages.

Buyers begin picking up smaller parcels and lots from the early large-scale speculators. A handful of small-scale buyers build houses, but most are speculating and plan to sit on the land a while before building or selling. Selling of nearby large-scale parcels continues.

When a developer begins offering a cohesive residential product, like a subdivision, and people start to move in, that’s a clear sign that an area is transitioning to stage 4. Various businesses soon follow, offering services to that residential base.

Stage 4 markets are marked by a critical mass of residents creating community infrastructure including restaurants, grocery stores, and tourism businesses. A significant number of tourists decide they like the area so much that they want to settle, and a lot more residential housing appears.

Larger businesses like supermarkets and hotels start to appear as stage 4 progresses. The area begins to be recognized for what it is rather than its potential, as businesses and community become established. Buyers of stage 4 properties tend to be individuals, entrepreneurs, and businesses looking to live, work, and do business in the area.

Simply flipping undeveloped land is a much more difficult business model in this stage.

When big chains start building and plans for a full complement of amenities and advanced infrastructure appear, that’s a sign that an area is advancing to stage 5.

Stage 5 areas are marked by full-scale commercial infrastructure, including a range of grocery, restaurant, and entertainment options, medical services, and maybe even an airport. Tourism is no longer an essential driver of growth as other forms of industries and incomes are established. Buyers purchase property for a variety of uses with the common characteristic that they plan to use the land.

Each of these stages presents unique opportunities and challenges. For instance, we have documented that raw land in stages 2 and 3 holds the most profit potential. Understanding the various stages of land development gives buyers and investors a sound framework to evaluate markets and make good business decisions.

Cardboard plans look pretty cool, but it doesn’t mean a project will get built or an area will take off.

After spending years studying the nuances of Market Stages, we have learned a few things about the way towns develop and how long it takes.

For example, let’s say a new international airport is introduced to an undeveloped region. Often speculators dive right in at the time of the announcement, buying big tracts of land. This can be a good strategy if you understand the customer at this stage.

However, if your plan is to build condos and sell to the people who will be coming you might have to wait a while. This obviously has an impact on the investment. We have found that it takes about 20 years to go from Stage 1 to Stage 5; this is an average, but clearly 20 years is a pretty long time.

Let’s say a location is in Stage 2, they are putting in a new road and you confirm a rumor that the government has created incentives to turn that area into a tourist destination.

The Market Stages system tells you who the first type of buyers are, and you could craft a message specifically for these people.

How?

Well, after becoming familiar with market stages you will see that Stage 2 is all about land investment and getting in early enough to ride the appreciation wave to Stage 3. It is also about choice. Stage 2 buyers often want the pick of the litter when it comes to land quality. There is no guarantee when areas will make it from stage to stage, but a new road and government incentives are a pretty dependable catalyst.

Another use for market stages is determining your exit strategy. If you buy in early Stage 4 or later you almost certainly have to build to create a return. This is fine if you know your market. However if you got in at stage 2 you could build to make money, but you could also just sell land.

Note: The absolute best return on land can be found at the end of Stage 2 transitioning to Stage 3.

Historically this is where money is made on land. There are less overall buyers for your land at this stage. But you can pick something awesome and there are many business models that work. The skillset needed here, as usual in this business, is getting people to your land and showing them the potential of the area.

A development in Ecuador, will it pan out? We think yes. It’s not the developers first project and it’s 85% sold.

As we always say, a bad real estate investment is the worst mistake we can make. This is because real estate is not a liquid investment, especially in this region.

Make a mistake on buying a project and it can be extremely painful and go on being painful for a long time. Not only do you lose money and suffer tremendous stress and waste tons of energy, you still have expenses to maintain the poor investment. It’s like being on a sinking ship and then having to pay more for the privilege of going down.

Say for instance land in a particular area is selling for $2 per meter, and then 20 people come in and buy land at that price. They all want to make money and they start trying to resell lots for $20 or $30 per meter.

In this particular scenario there has been no change other than that the land is for sale in smaller chunks at a higher price. The developers are promising a bright future with paved roads and hundreds of houses, and that is their justification for the higher price, but that is then and this is now.

This scenario happens for various reasons all over Central America. A notable example of the above is the Pedasi area of Panama. Developers bought big properties with the idea of selling lots and houses, but their prices are too high to create healthy sales. So the land just sits, selling very slowly if at all. This type of situation is what we call a “log jam.”

What this means is that prices increased too quickly. The sellers have priced their land from a Stage 2 price to a Stage 4 price and hope to attract Stage 4 buyers. Fundamentally the market is still a Stage 2 market; it has not made the essential changes that create the services a Stage 4 buyer looks for.

The developers are promising hundreds of homes in their developments someday, and they’re trying to sell for prices that would only be appropriate if there already were hundreds of homes. The reality is that there is a treeless farm with some roads, an entry feature, and maybe a few houses, but the future of hundreds of houses is years if not decades away.

Note: This example comes from years ago when we scouted the area.

When this happens the properties may sit unsold indefinitely or at least until some sort of major infrastructure change

occurs: a better road, a big international resort or marina, or a hospital, for instance. Once one of those fundamental changes occur, then the higher land values could become justified because of increased demand.

Market Stages was designed to allow you to make these types of considerations before buying. When used as framework for making buying and selling decisions, the system can be extremely influential in making sound investment decisions. When you become familiar with the system you’ll see into a town’s future and make informed decisions years in advance.

This is a general term that basically breaks down this way: If you can’t get there, it has no real estate value. On the flip side, the more people who can get somewhere the more value the land has.

Access is like air for you and me when comparing its importance to real estate investment in emerging markets.

It can mean more than just getting there, but it will always be the catalyst for growth. Find changes in accessibility and you will have a very profitable investment career.

Access alone can change values.

So many times I have seen a new airport or a new road or electricity announced and watched the land values change overnight. Other important catalysts to look for are government incentives that make projects more cost-efficient, as this increases access for capital to be invested in the area.

A number of things can change access.

No access, no value.

Don’t limit your thinking just to physically getting there. It’s also about who has access to an area.

Some places have a nice road but still aren’t fun places for families to live, effectively blocking their access to the market.

Access to a quality school is a major determining factor when expat families are looking for a destination that will meet their needs. In Nosara Costa Rica, some friends of ours created a school. Within four years the number of families nearly doubled in that town. This is because the school created access for families with kids to live in Nosara, when they couldn’t before.

When evaluating options for investment think both long term and short term when considering access. We like places where physical access is about to improve due to a new road or bridge, but this is usually not enough on its own. We also need to believe there are other trends in place that will sustain a project over the long term.

An example of this is the well-documented trend of more and more people deciding to

This stretch of coast has no road, but you better believe we will be ready when it does.

move abroad. Another is that the amount of baby boomers looking for second homes is increasing on an annual basis.

If you really understand access you can look at different towns and figure out which ones are going to grow faster than others. This is

more complicated because it is not about a single change, but rather a myriad of changes that happen or factors that are in place to build momentum.

On the Ecuador coast we came across a stretch that was more or less barren. No buildings, just dusty farm land. But a new highway had been built. After spending four days there, we were able to figure out that over 5,000 residential units spread over six or seven independent projects were about to be built now that the new highway was finished. It was pretty obvious that access had made it all possible.

If you are looking for long-term value or short-term value changes look no further than access. In a practical sense you could be looking at two properties that are equal, but one has the benefit of being closer to a main road. Most people would pick the property with easier access, but when it comes to larger access points like highways or airports you can generally check up on these projects by using an attorney, and you should.

Another thought here is that when deciding between two places, look at which one provides the most access and what could change in the future.

Without a doubt this concept will be the single biggest determining factor of land prices and future value. Look for the changes that are about to occur and focus on them.

New highway outside of Bahia, Ecuador.

Roasting hot dogs on a beautiful beach in Central America.

What’s going to determine long-term appreciation in your real estate investment more than any other factor?

Community.

It’s strange to think about a community’s value when you invest or look for a place to live. The group of people who call a place home has everything do with how a place is perceived and therefore who it attracts.

It is that perception that determines value, but it doesn’t end there.

Community can change over time and usually does ebb and flow like most things in nature. A community might start out with hermits who hate people, and evolve over time into a family-friendly beach town.

In this sense, developers, small business owners, and locals are the image makers. It’s the image they create that attracts members.

This is a very powerful concept for you as a community maker and long-term investor.

How many times have you heard people say, “I don’t really like this place, but I love the community”? The odds are pretty good you have heard that statement a lot more than you have heard the opposite. “It’s a beautiful place, but we hate the community”. In other words most of us could live on the North Pole if we loved the community.

Good community is like the glue that keeps us stuck to a place. Without it we are going somewhere else.

Interestingly enough, community is generally the least understood component of investing. But after years of watching communities in Latin America grow and flourish or stagnate and rot, we have learned some valuable lessons.

In North America, creating community or choosing community based on personality is not something that leads your decision- making. You live where you work or where your kids go to school or even near family. The choice of where to live is based on these external circumstances.

This is not the case for expats in Latin America. Here people choose where they will live based on what they like. This is why understanding your buyer is so important.

There are many personalities in the different towns from Nogales, Mexico to the Border of Peru and Ecuador.

Towns start growing because of access but they develop personalities based on the community. Great success stories are often linked to a town’s personality matching up to a large group of people who appreciate those qualities.

A community of people who hate other people is likely to grow much slower than a multi-faceted community that embraces new members with open arms.

Gathering coconuts with friends in Boca Chica, Panama is a great way to spend the morning.

When we started our Playa Burica Project we were challenged to mesh an active community with a wild, untamed place. The answer was certainly not marketing to condo buyers since we were the first project there.

We had to go outside the box and develop an easy and simple style of living while focusing on the kind of customer who would value the area.

The strength of Burica was that it was perfect for people who want to get away. You can hike the beaches alone, explore, fish, or surf without any crowds. We wanted to build a community for those who love nature and wilderness and living simply.

Once we had this figured out we were able to craft a message to attract these people, and that is exactly how it has worked.

You might be surprised to find that there are more than a few people with grandkids who spend time in Burica every year.

When you are building a community, you want to attract people who fit the area. If you do they will attract people like them, which is the beginning of good community.

This is like shopping for groceries. Are you a Whole Foods person or a Walmart guy? Both are fine, but there are different priorities for each group.

When considering where to buy, spend some time in the community and see if it matches your values.

If the place is really new, get a feel for the surrounding area and see what is happening. Is there enough energy invested to take the place to the next level, or is it OK with you just as it is? If you like it just how it is, that is a really good sign because that way you aren’t investing and waiting for change. You can just enjoy it now.

Some areas are so new that the first project there is the only thing happening.

Seeing who they are attracting is a good clue for guessing what direction things will go in. If you like what you see, great. If you think it’s all wrong, there might be an opportunity for you to do your own project.

Watching the waves, a typical community experience in Playa Burica.

There are several sections to this book and, as you go through them, you may lose sight of which steps come first. Or you might pick this book up after months have gone by and realize you’ve forgotten what to focus on.

Bookmark this page to go over as you develop your strategy.

We’re heading in to scout a new area.

While what we do is mostly buying larger parcels of land, our system can also be used for lot buying or home buying for investment. The general concepts described in this book will give you the framework to narrow down your investment options.

When you buy a lot or house in a development, you are effectively tying your horse to someone else’s wagon via the developer-buyer relationship. If you don’t like the developer, it may be a good idea to buy somewhere else.

Lots and houses don’t offer as much control when it comes to exit strategies. On the other hand, you have more control over where your lot or home will be.

If you are buying a lot or house early in a project, you need to understand that the future dream you are being sold may not happen

Boca Chica Island, Panama. www.bocachicaisland.com A Viva Tropical island community designed for people who want nature & solitude.

Developers need to be funded, have experience, and have something to lose to even have a chance of success. Having no debt is another good quality.

Find out as much as you can about the developers. See if they have a track record.

Your quality of life and purchase will be linked to the developer for as long as you live or own there.

Try to find something that speaks to you and your ideas, something you can get behind and enjoy over the long term. In terms of picking your perfect lot or house, take your time and look. Embrace the research phase. Look at lots of properties and use the information in this book to help make a profitable and positive decision.

As with all real estate, the best investments are the ones that rise in value the quickest and longest. You will have to balance the upside of a community with being realistic.

In the Market Stages section we discussed that land can take around 20 years to go from agricultural land to a full blown town, and there is no guarantee it will get this far.

Focus on what is drawing people to the area. Is it surfing? Or maybe value? Maybe it’s a good school. What you are looking for in a perfect world is a developer who knows what they are doing, and an area that offers a wide group of people many different reasons to come.

Welcome to the San Jose International Airport in Costa Rica.

Ultimately this is what has led to Costa Rica’s success as a country. It is appealing to many, many different types of people, while the other countries in the region are not quite as appealing in a general sense.

You don’t want houses starting to fall over or get leaky roofs in the development where you own. We have seen projects start out great then suffer over the mid term when the developer skimps on building quality. As a result, the whole project suffers. Building quality is something that your network should be able to help you understand if you do not know what to look for.

Overall, when you buy a lot or house inside a project, your future will be tied directly to the developer’s ability to execute. The number one thing to look for is whether the developer has ever done a project in Latin America.

If not, their odds of performing well drop precipitously. Even if they have tons of money, lack of experience can be enough of an obstacle to prevent money from solving their problems. If time is limited, make sure to find out as much as you can about the developer before you commit.

They don’t make them like they used to. This church in Granada is literally hundreds of years old.

I know that we’re talking about a huge undertaking here. Making a smart investment in the Tropics is going to take lots of work. Building a community might be a lifelong endeavor.

You might not be ready to make that type of commitment yet. Does that mean that you can’t hit Pay Dirt?

I don’t think so.

And we might just have a way to hit pay dirt together…

Capitalize on the investment blueprint that you discovered in Pay Dirt.

Viva Tropical offers to our subscribers insane deals on land that are simple, effective, and profitable.

Take advantage of our special offers like the Early Bird Program or our Bulk Buying Discounts.

Through these programs you can buy land for as low as $30,000

You’ll reap the rewards of a management team that’s scouted more than 3 million acres of property, driven the pacific coast from Mexico to Ecuador, and purchased over 8 miles of coastline.

This matters because as we develop a community the right way you will benefit hugely by being part of it as a resident or as an investor.

Don’t hesitate to get in contact with us to see hear about our latest offers.

Anybody can buy real estate. Anybody can buy land in countries like Panama. But what makes Josh and Park stand out is they can actually sell it, making investors money when traditional sales channels flounder because they can’t deal with the changing market.

(Largest Brokerage in Panama)

Emerging Terrains’ projects have been in my top 5 most popular listings for a long time now. If anybody knows how to buy and sell land in Panama, it’s them.

You guys made me money in your last project. Please, please, please let me be part of your next deal.

It’s simple to get started.

Simply fill out the form below and get qualified. Then we’ll have a confidential call to discuss what offers we have available.

After that call, we’ll send you our simple, straightforward documentation for your and your advisors to review.

Then you’ll reserve your purchase slot for 60 days and come down to visit us and the projects. Some buyers simply invest without making the initial trip.

That option is OK, but we’d prefer that you come down and get to know each other better.

Fill out the form below and we’ll be in touch.

We have been scouting the Latin Tropics for investments for more than 15 years, bought and sold miles of coastline successfully, and I’d like you to become part of our next project.

If you want to get started now fill out the form to the right, and my assistant will arrange a time for you and me to have a confidential chat about you investing in our next project. Let’s have a candid discussion about your goals and see if I’ll be able to help.

We don’t spam. And we value your privacy.

Thanks! If you qualify, my assistant will arrange a time for you and I to have a confidential chat about you profiting as an investor in our next project.

We receive lots of requests from new buyers and only have early bird and special deals available for limited time periods. We simply don’t have the capacity to keep adding new projects AND deliver an amazing experience for the folks buying into those properties.

So we tend to open investment opportunities for a short time while we fill available slots, then close them until next time.

Contact me today for your consultation and make sure you don’t miss this window of opportunity.

Sincerely,

Josh Linnes

P.S. Our investors come to us because they demand a developer they can trust and a business model that’s simple and effective. Contact me today to block anyone else from taking your slot.